tax avoidance vs tax evasion australia

The main difference between tax evasion and tax avoidance is that evasion is an illegal activity meant to deliberately dodge tax expenses and avoidance is the highly. To start with tax avoidance.

The Pandora Papers Show The Line Between Tax Avoidance And Tax Evasion Has Become So Blurred We Need To Act Against Both

The goal of tax avoidance is to lower ones tax burden.

. Tax avoidance uses lawful methods found in the tax code to cut your total tax liability. The distinction between tax avoidance and tax evasion has been well established in the australian taxation system. The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system.

The major difference between tax avoidance and tax evasion is that the former is legal while the latter is illegal Murray 2017. A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of probability less than 50 of surviving a tax audit. Tax Evasion vs.

Tax avoidance is to decrease the tax. Tax avoidance can easily lead to fraud and evasion depending on methods adopted to circumvent anti. Tax avoidances repercussions tax burden is postponed.

Tax avoidance is just avoiding while tax evasion is to break all rules of the tax. Tax envision is suppression of tax while tax avoidance is hedging of tax. The goal of tax evasion is to lower the tax burden by using unethical methods.

The main objective of a tax advisor is to assist hisher clients avoid taxes as much as possible through within the confines of the law in. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of. The most serious tax fraud.

The line between tax avoidance and tax evasion is not clear cut. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the. The difference between tax evasion and tax avoidance largely boils down to two elements.

At its core it requires deliberately structuring your assets in such a way that you pay as. The difference between tax avoidance and tax evasion boils down to the element of concealing. Tax avoidance and tax evasion are different methods people use to lower taxes.

While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very. What is the main difference between tax evasion and tax avoidance. While you get reduced taxes with tax avoidance tax.

Tax avoidance is structuring your affairs so that you pay the least amount of tax. Tax evasion vs tax avoidance. In tax avoidance you structure your affairs to.

However for some time the Australian Government. Excerpt from Essay.

Tax Driven Wealth Chains A Multiple Case Study Of Tax Avoidance In The Finnish Mining Sector Sciencedirect

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Requalification Of Tax Avoidance Into Tax Evasion

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Avoiding Tax May Be Legal But Can It Ever Be Ethical Guardian Sustainable Business The Guardian

Tax Evasion V Tax Avoidance Is There A Difference Pace International Law Review

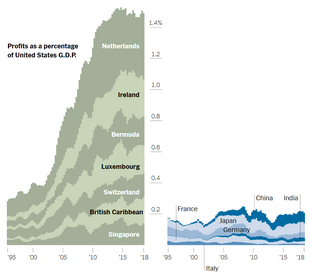

Where Are The Worst Tax Havens In The World Oxfam Australia

Tax Avoidance Definition Business Examples Tax Saving Loopholes

Tax Avoidance Vs Tax Evasion Differences You Need To Know

Australia Says G 20 Committed To Fighting Tax Avoidance Wsj

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Hundreds Of Companies Pay No Tax Says Ato As It Releases Latest Corporate Tax Transparency Data Abc News

Explainer The Difference Between Tax Avoidance And Evasion University Of Technology Sydney

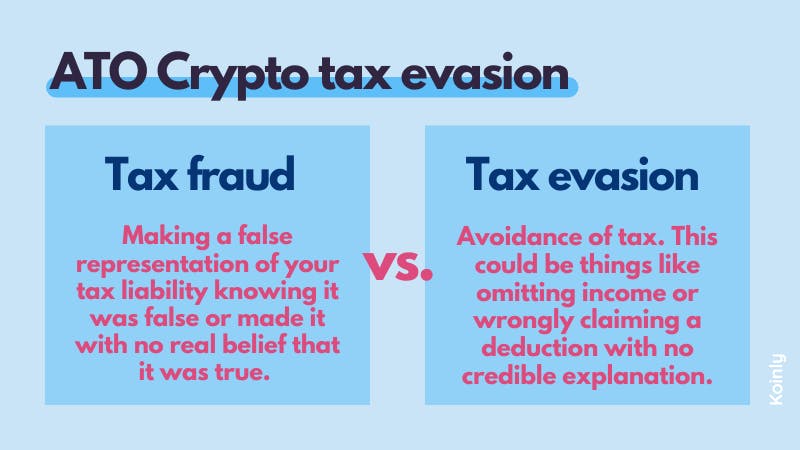

Ato Crypto Tax Evasion Risks And Penalties Koinly

Tax Avoidance V Tax Evasion Lawpath

Tax Driven Wealth Chains A Multiple Case Study Of Tax Avoidance In The Finnish Mining Sector Sciencedirect